Industry

Your Holiday Payments Playbook

The Pagos team has long touted the gospel of driving business revenue and growth with payments. Payment processing sits at the center of your business and at the heart of your profits. If you want to win more customers, earn and retain more revenue, and drive business growth, you need to see payments in this light.

If you already do, you likely spent 2025 optimizing your payment processing—testing and refining your routing strategy, designing your retry logic, identifying the ideal payment method mix, and more. You’ve built a finely-tuned machine, and now it’s time to prove your resiliency at the time it matters most: holiday shopping season.

Freeze!

Now that Q4 is winding down and holiday shopping is in full swing, it’s time to stop making payments optimization adjustments. You won’t hear us say that very often, but this is the exception. You’ve already done the work to create a system where transactions flow smoothly; now it’s time to lock things in and let it play out.

The holiday season can result in 5-10x your normal transaction load, meaning any outages or issues will compound into massive opportunity loss. When your payments set up is stable and well understood internally, you can easily spot problems and react quickly when it matters the most.

Monitor, React, and Report

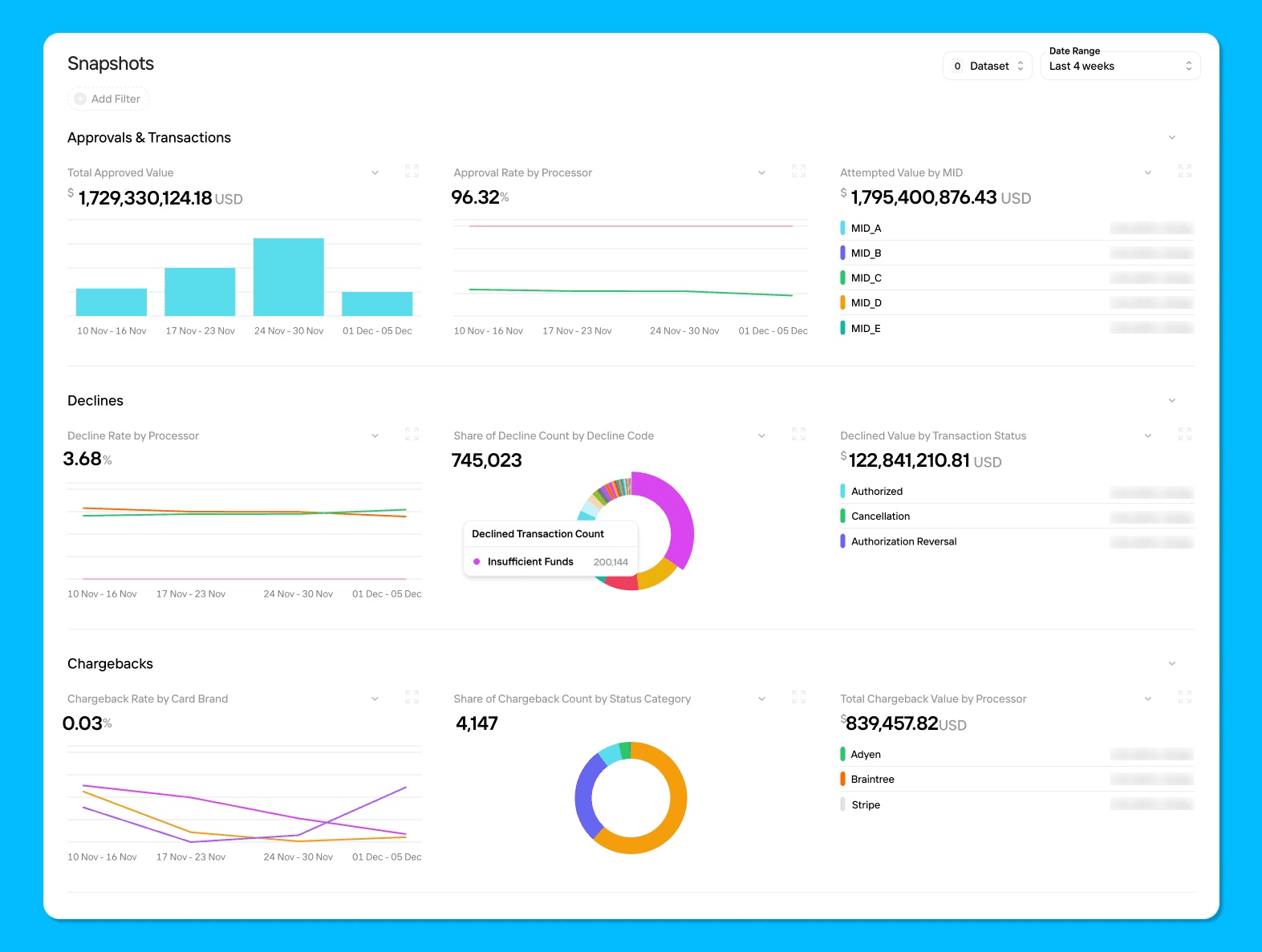

By hitting pause on optimization experimentation, you can focus exclusively on active monitoring this holiday season. You should be checking key metrics multiple times per day (or let Pagos Alerts monitor for you), including:

Approval rates by processor, payment method, and region/country - Keep an eye out for outages, processor latency, fraud attacks, or any internal issues impacting approvals.

Decline volume and decline code mix - Be prepared for a slightly different decline code mix than the rest of the year; the increased transaction volume means issuers are managing higher risk levels, and declines may reflect their elevated caution. This can impact your typical decline code-based retry strategy, so be prepared to make minor adjustments as needed.

Transaction attempt patterns - As always, spikes in attempts from a single BIN could indicate a carding attack.

Payment method mix shifts - Customers may opt for credit over debit or turn to flexible payment options like Buy Now, Pay Later (BNPL) more readily during the holidays. These shifts are normal, but you need to ensure the payment methods your customers prefer are working flawlessly and prioritized appropriately in your checkout flow.

Benchmark comparisons - Compare your real-time performance to market benchmarks whenever possible. A dip that affects only your business could indicate a processor issue, a configuration problem, or a targeted fraud attack.

Your executive leadership will likely request updates on your monitored payments data throughout peak shopping periods. You need clear, consistent metrics reports on hand to deliver at a moment’s notice. For example, the following Pagos Snapshots dashboard segments transactions and declines for easy review and consumption:

Stay Aligned Across Teams

Internal teams across your business need to be in sync throughout the holiday season. For example, ensure your Fraud and Payments teams are coordinated regarding concerning patterns like dips in approval rate or spikes in fraud-related decline codes. Similarly, your Support team needs real-time visibility into payment issues like processor outages to answer customer questions accurately. Failed transactions may drive good customers away, but false or confusing support information definitely will.

Extended Monitoring Post-Holidays

Once the shopping frenzy winds down, the holiday hangover begins: returns, refunds, and chargebacks.

Everyone knows gift recipients will return purchases. The question is: what should you be looking out for while this is happening? Track returns and refunds by product type, payment method, region, and customer segment to identify patterns. If returns are concentrated in specific reason categories or with certain payment methods, this could indicate a larger issue impacting customer loyalty or even first-party misuse.

Chargeback lag means chargebacks will keep rolling in through early 2026. Not all indicate fraud—sometimes shoppers genuinely forget they made an eggnog-fueled impulse purchase. Strong recordkeeping is your best defense. Retain detailed transaction metadata and customer communication history as it comes in to fight friendly fraud effectively.

As a side note, don’t forget about the recent launch of Visa’s new Visa Account Monitoring Program (VAMP)! This change means it’s especially important to stay on top of your Visa dispute volume; learn more about how Pagos can help you monitor your VAMP risk exposure in a previous blog post.

It’s Holiday Go Time

You spent the year testing and tuning your payment systems for the big event. Now that you're here, your strategy is simple: lock things down, monitor intensely, and react fast when issues arise. Optimizing for performance and revenue capture during this critical window will ensure your company has the best holiday season ever—capturing every possible dollar and keeping customers happy through a seamless checkout experience.

When it’s all said and done, celebrate your success as a payments team with reports demonstrating the ROI of your payments optimization work. You may even make the case with executive leadership for continued investment in payments as a business driver in the new year!

And if you didn’t feel as optimized as possible going into the holidays this year, Pagos has everything you need—from payments data aggregation and visualization to automated monitoring and benchmarks—to cut costs, drive revenue, and create better customer experiences in 2026.

Now get out there and make the most of these final weeks of the year. Happy Holidays from the Pagos team!

By submitting, you are providing your consent for future communication in accordance with the Pagos Privacy Policy.