Industry

Designing a Buy Now, Pay Later Strategy

December 11, 2025

December 11, 2025

Grace Greenwood

Grace Greenwood

Grace Greenwood

Buy Now, Pay Later (BNPL) has been steadily increasing in global popularity over the last decade, with options like Klarna, Afterpay, and Affirm swiftly becoming household names. Fortune even reported US customers using BNPL options to spend $1.03 billion shopping online Black Friday sales this year; roughly 7.2% of all US sales that day can be attributed to these installment-based payment methods!

We can link this growth to evolving consumer preferences. BNPL providers have ardently designed products consumers gravitate towards and delight in using. Additionally, BNPL offers budget-conscious shoppers the option to break larger purchases into manageable installment options—transforming "I can't afford this" into "I can make this work."

While there are real pros and cons to accepting BNPL, it’s a payment method most larger merchants have embraced, especially in Europe and the US. But here's what many miss: if you're already accepting BNPL, you might be leaving significant revenue on the table if you haven't optimized your installment strategy! The real question isn't whether to accept BNPL, but which payment types and how many installments to offer.

Higher Installments, Higher Order Values

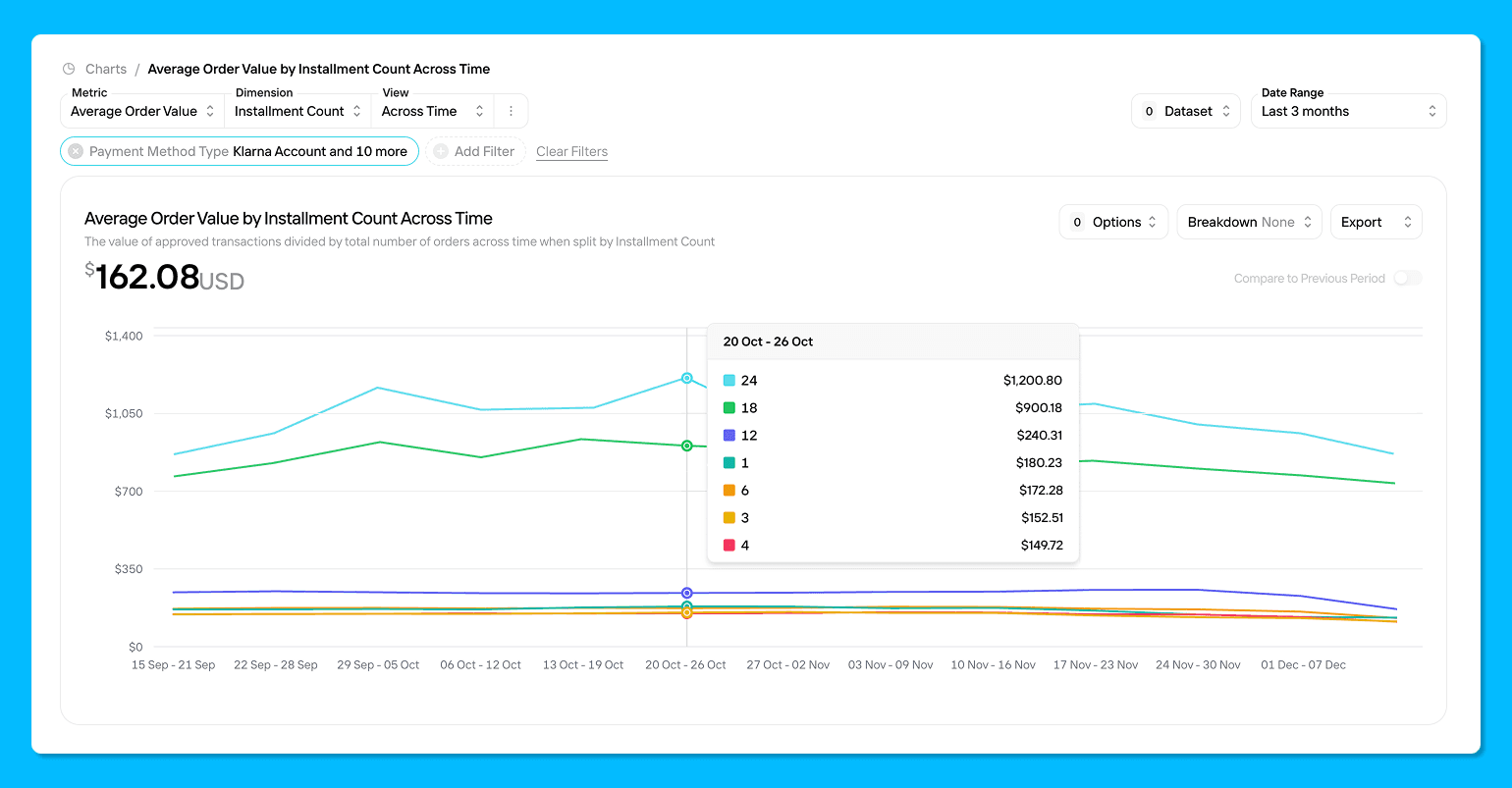

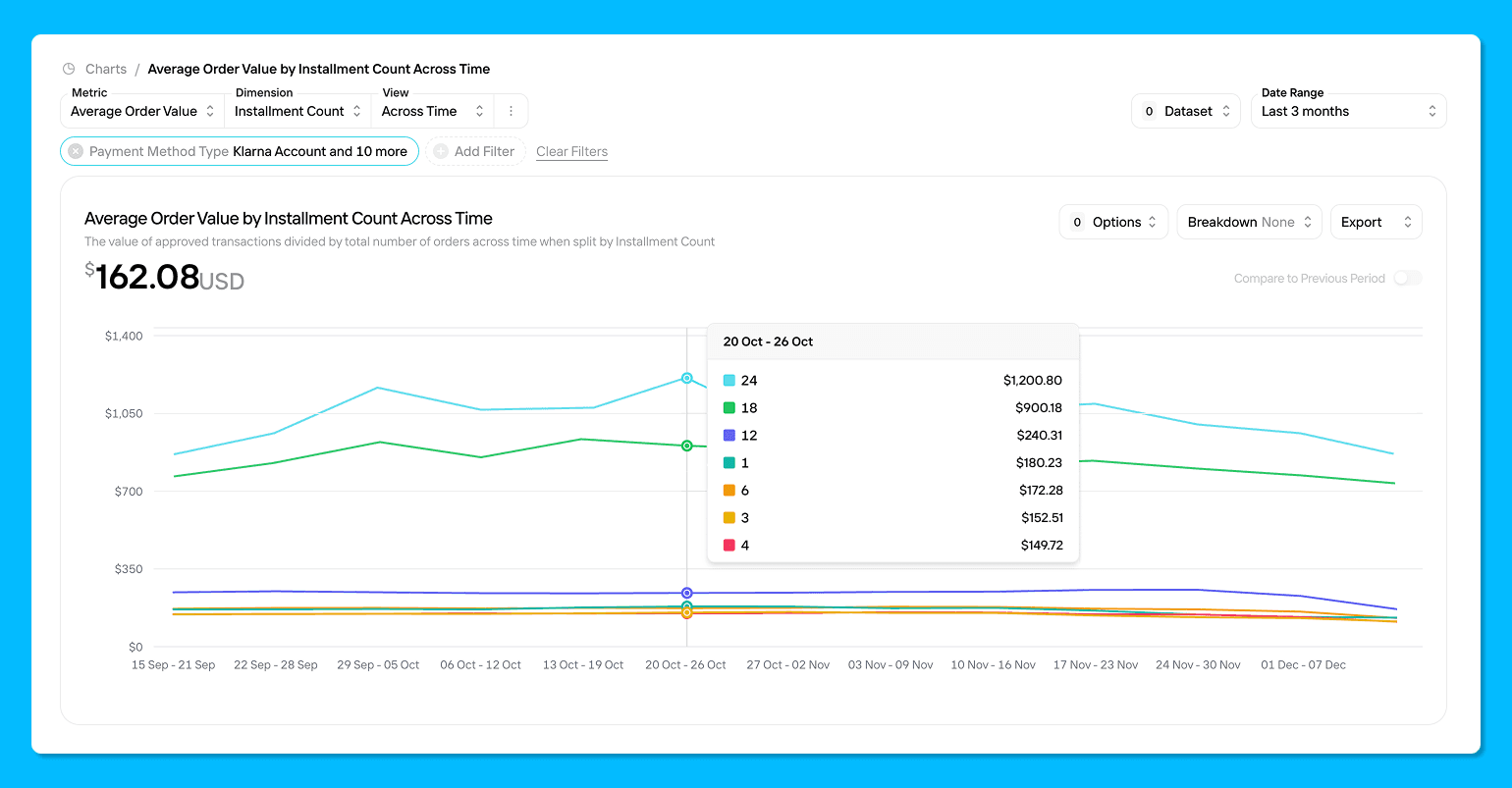

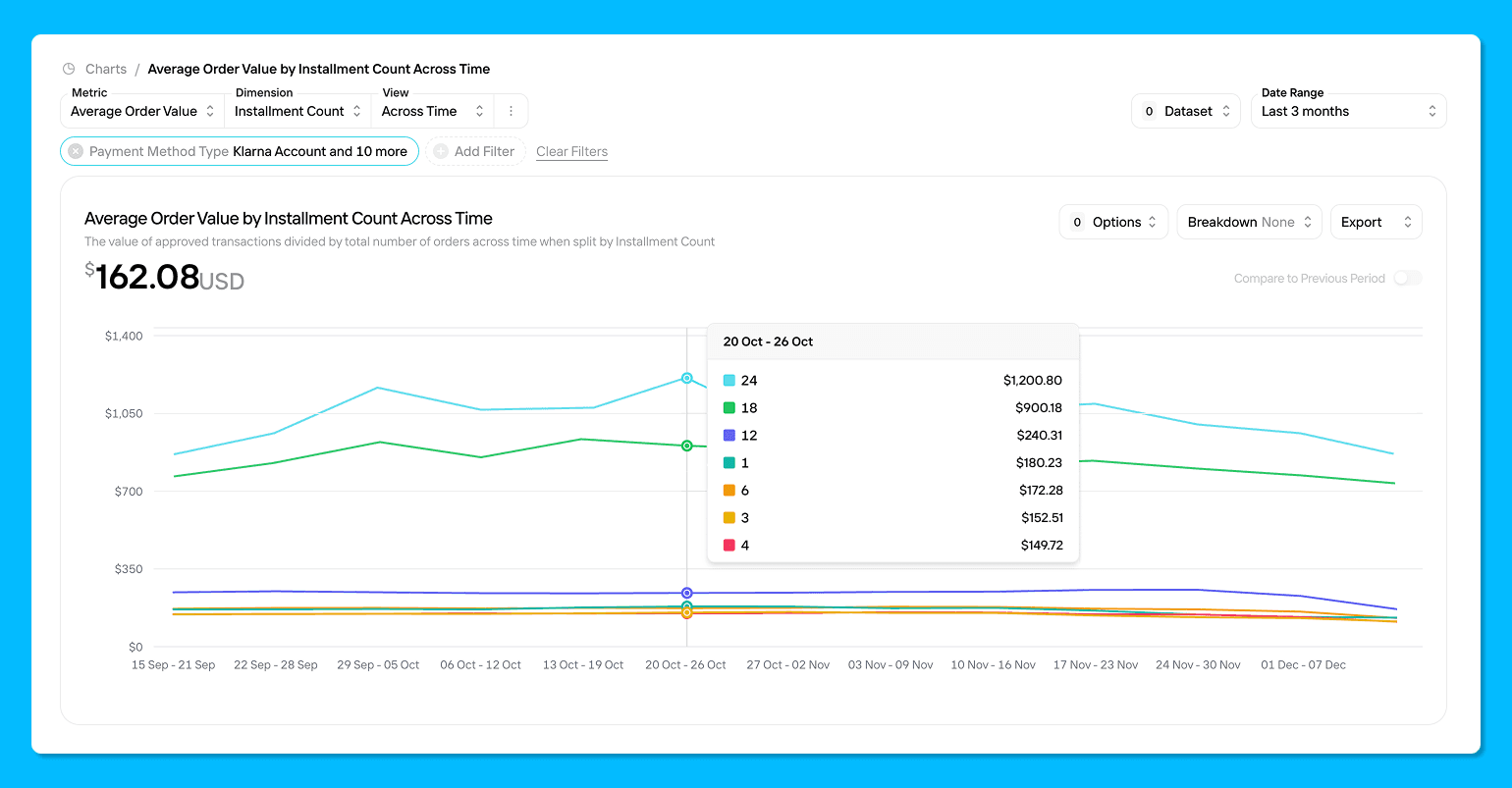

One of the primary benefits BNPL options like Klarna offer merchants is an increased average order value (AOV). Interestingly enough, we’ve witnessed an extension of this benefit in the data for some of Pagos’ international retailers accepting various Klarna payment methods in the US and Europe: higher installment counts correlating to higher AOVs.

Look at that AOV pattern:

Single installment purchases: ~$165

12 installments: ~$240

18+ installments: >$800

When customers know they can spread payments across more paychecks, they're comfortable spending significantly more. This makes intuitive sense—someone budgeting $200 per paycheck can afford a much larger total purchase over six payments than over three. At this point, the optimization insights seem clear: If you're already accepting BNPL but only offering 3-6 installment options, you might be leaving money on the table!

That being said, we are still talking about the complicated and intricate world of payment processing. Our next step is to look at the tradeoffs.

The Tradeoffs: What You're Paying For

Higher Processing Costs

Of course, BNPL isn't free. The benefits come with clear costs—literally. BNPL providers charge more than traditional payment methods, with fee effective rates typically running consistently higher than non-Amex credit cards. You're essentially paying for the increased AOV and conversion. These costs can vary across retailers, BNPL partners, and market, so you’ll want to perform a full cost analysis whenever adjusting your BNPL strategy.

Complex Refund Dynamics

This is where BNPL gets interesting—and where your market matters. We analyzed data from global retailers operating in the US and Germany and dug into the refund rates across all BNPL transactions made between January and November of this year. Here’s what we saw:

In the US, BNPL refund rates hover around 11%. This is manageable and actually lower than the 13% average for credit cards.

In Germany, however, those same retailers saw BNPL refund rates spike to 35-45%! The main difference appears to be the popularity of "try-it-at-home" BNPL options like Klarna Invoice in Europe. This particular offering allows customers to receive and use an item for up to 30 days before they pay via a single invoice. When customers can test out a product without paying, they seem more prone to adopt the "eh, send it back" mindset; in fact, 91% of BNPL refunds for one of these merchants in Germany came from this try-before-you-pay model. Further enforcing this conclusion, we see refund rates around 12% in Germany for installment-based BNPL options like Klarna Slice It.

Just to be thorough, we also compared refund rates across non-BNPL payment methods in Germany and the US. Credit card refund rates are also higher in Europe (18-30%) than in the US (11-13%), which suggests broader regional differences in shopping behavior, return policies, and consumer expectations. This regional variation is just another factor to consider when deciding what payment methods to accept in which markets. The decision comes down to whether the increased AOV and transaction volume is enough to offset processing and refund costs—and that calculation often looks different across markets and payment methods.

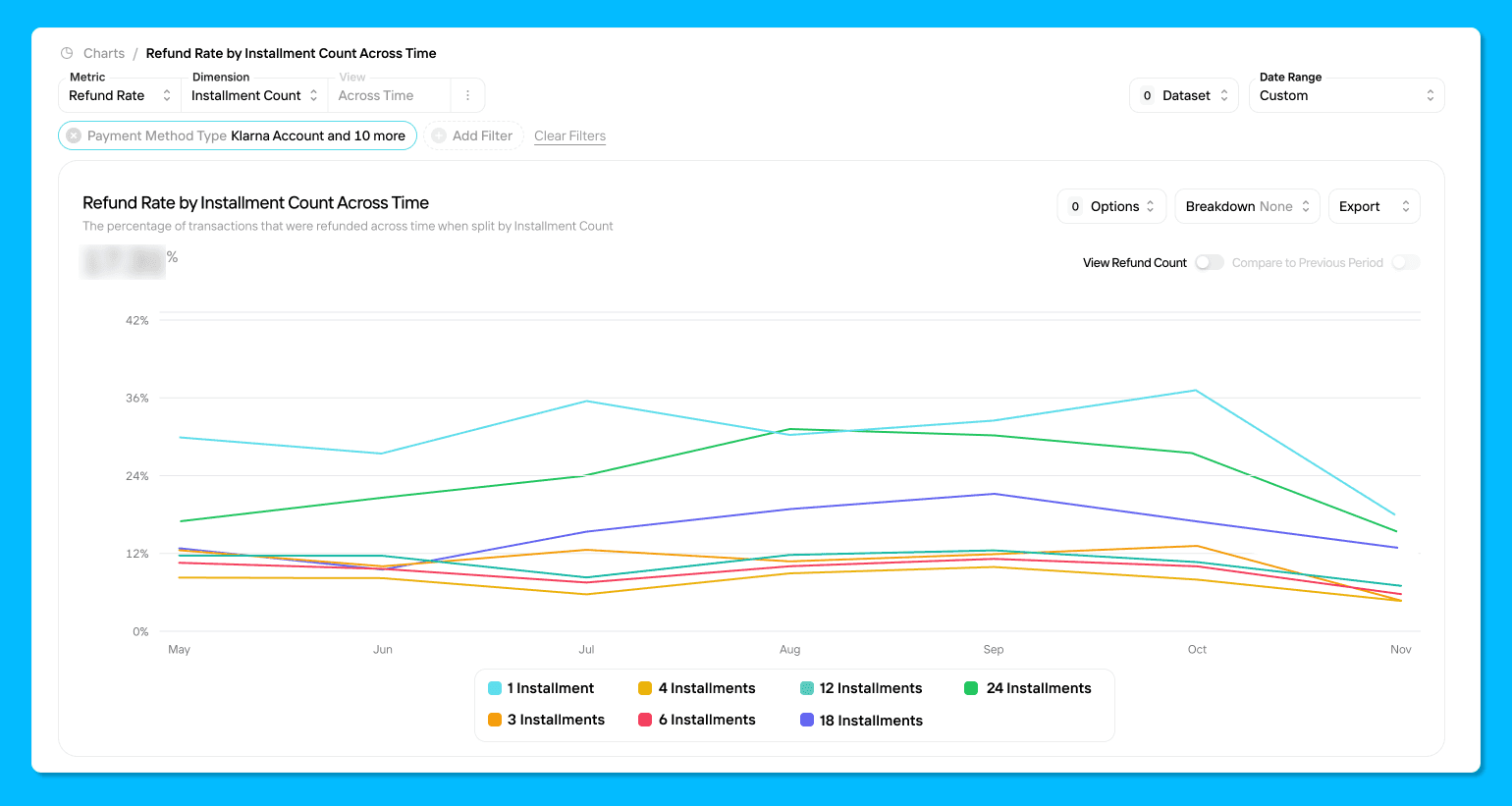

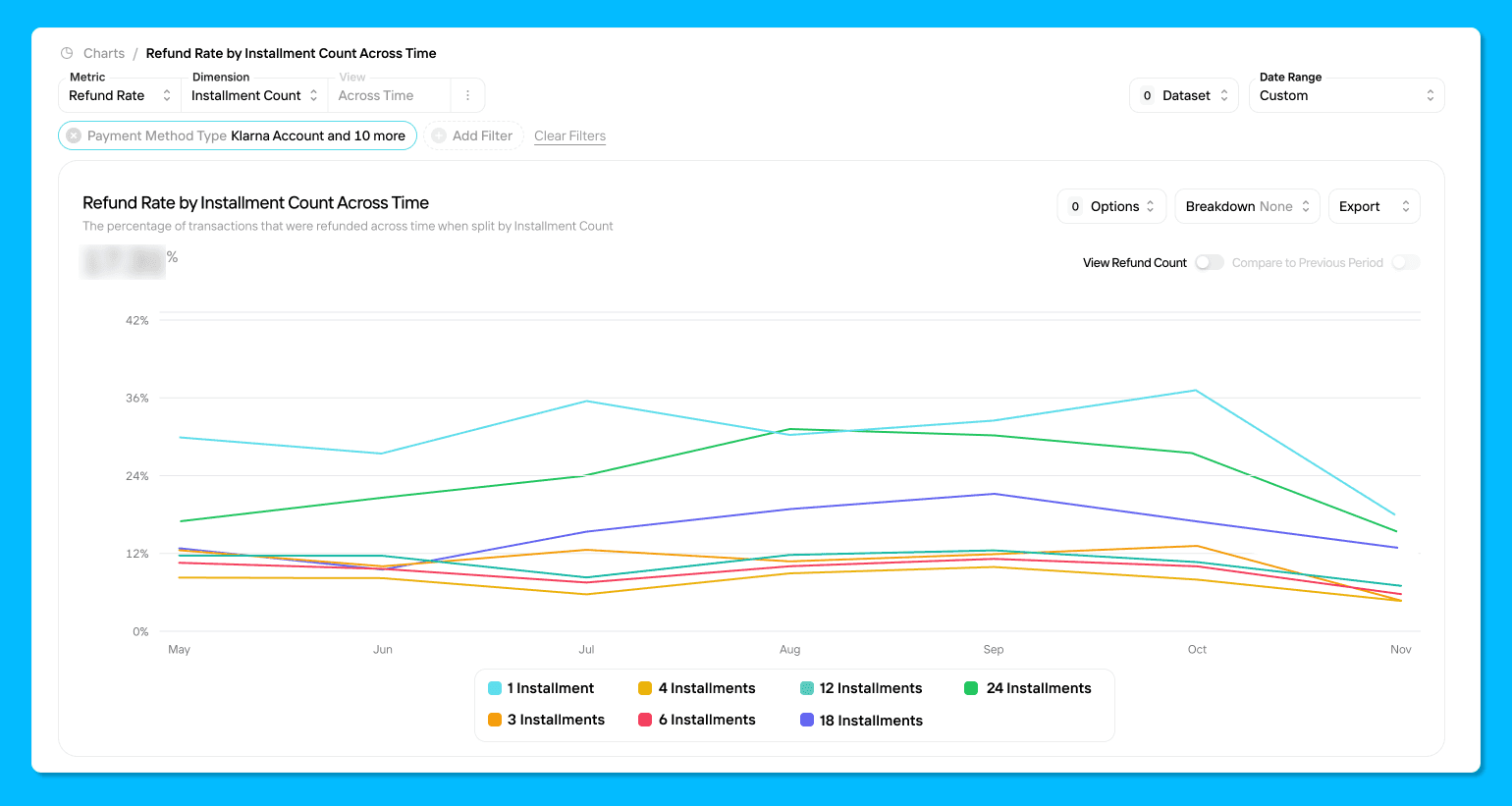

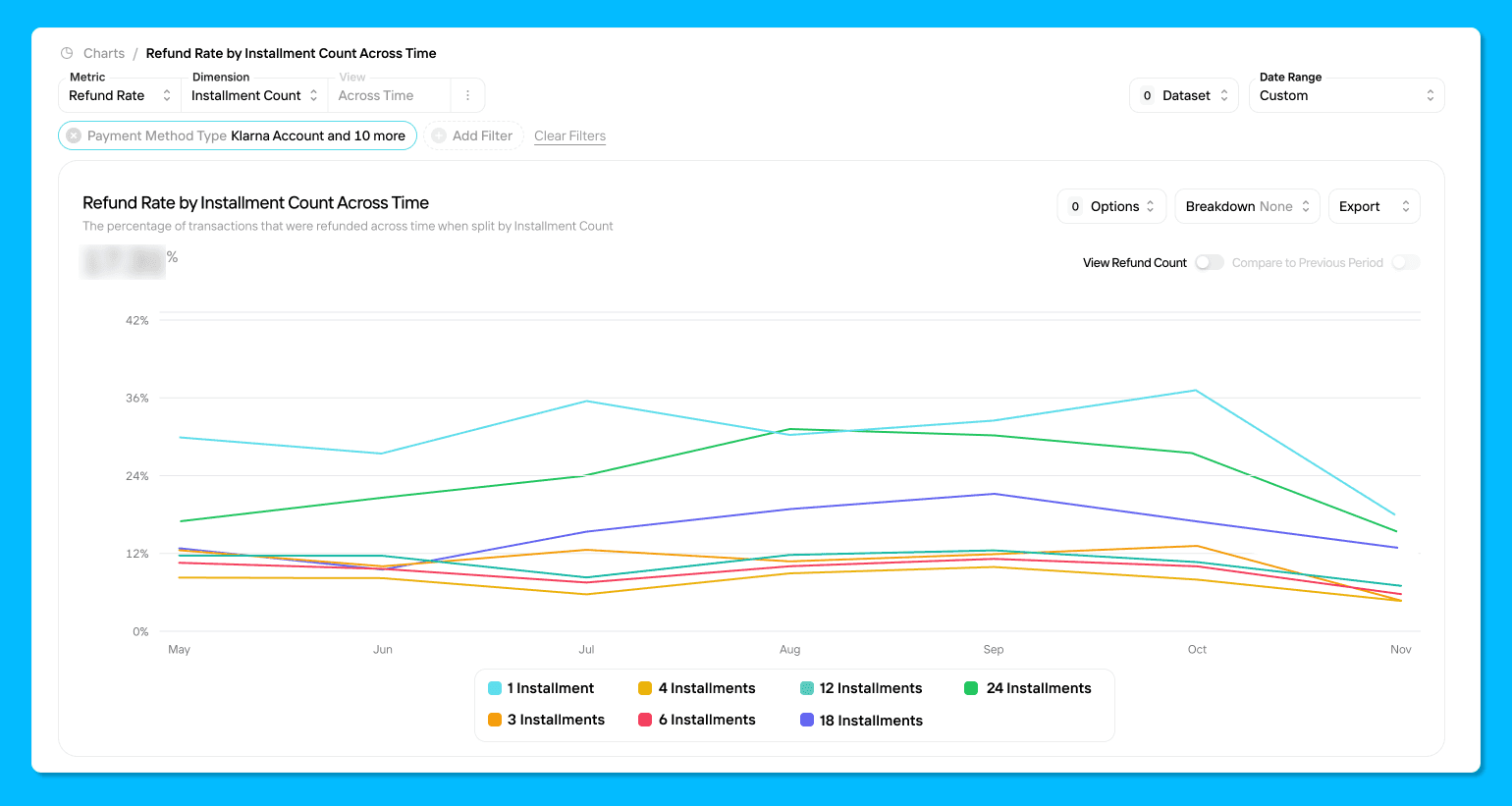

What about installment counts? Even within installment-based BNPL, refund patterns for transactions with various installment counts aren't exactly linear. Here’s an example of what we saw for one of our merchants across all of their BNPL volume in the last six months:

1 installment: 17-37% refund rate (consistently highest)

3-12 installments: 4-13% (lowest range)

18-24 installments: 14-28% (mid-range)

The takeaway? Refund rates depend on your market, your BNPL payment offerings, and your customer base. You need to monitor your own data to understand how different BNPL configurations affect your returns.

Your Next Steps

If you're not offering BNPL yet, you may want to add it to your payments stack. Customers want it, and they spend more when they have it.

But if you're already on the BNPL train, don't assume you're done optimizing! Here are some actions to consider:

Audit your installment options - Are you capping installments at 3-4 when customers might be inclined to spend more if they can break transactions across more installment counts?

Monitor your refund patterns - Do higher installment counts or certain BNPL payment methods correlate with more returns for your business and products? How does it vary by market?

Calculate your net benefit - Does the increase in AOV offered by higher installment plans offset the processing and potential refund costs?

Test and iterate - Try offering more installment options to a segment and measure the impact! (Remember, A/B testing is one of the pillars of payments optimization).

You Can't Optimize What You Can't See

This is precisely why granular payments visibility matters. When you can break down AOV, refund rates, and fees by payment method and installment count, suddenly you're making strategic decisions instead of flying blind.

With Pagos Insights, you can visualize your entire payments dataset with the granularity to necessary to view AOV, costs, refund rates, and more across BNPL payment methods, installment counts, markets, and more. Only with this information can you ensure your BNPL strategy is optimized for both customer budgets and your bottom line.

Ready to dig into your payments data? Contact us to get started with Pagos Insights.

Buy Now, Pay Later (BNPL) has been steadily increasing in global popularity over the last decade, with options like Klarna, Afterpay, and Affirm swiftly becoming household names. Fortune even reported US customers using BNPL options to spend $1.03 billion shopping online Black Friday sales this year; roughly 7.2% of all US sales that day can be attributed to these installment-based payment methods!

We can link this growth to evolving consumer preferences. BNPL providers have ardently designed products consumers gravitate towards and delight in using. Additionally, BNPL offers budget-conscious shoppers the option to break larger purchases into manageable installment options—transforming "I can't afford this" into "I can make this work."

While there are real pros and cons to accepting BNPL, it’s a payment method most larger merchants have embraced, especially in Europe and the US. But here's what many miss: if you're already accepting BNPL, you might be leaving significant revenue on the table if you haven't optimized your installment strategy! The real question isn't whether to accept BNPL, but which payment types and how many installments to offer.

Higher Installments, Higher Order Values

One of the primary benefits BNPL options like Klarna offer merchants is an increased average order value (AOV). Interestingly enough, we’ve witnessed an extension of this benefit in the data for some of Pagos’ international retailers accepting various Klarna payment methods in the US and Europe: higher installment counts correlating to higher AOVs.

Look at that AOV pattern:

Single installment purchases: ~$165

12 installments: ~$240

18+ installments: >$800

When customers know they can spread payments across more paychecks, they're comfortable spending significantly more. This makes intuitive sense—someone budgeting $200 per paycheck can afford a much larger total purchase over six payments than over three. At this point, the optimization insights seem clear: If you're already accepting BNPL but only offering 3-6 installment options, you might be leaving money on the table!

That being said, we are still talking about the complicated and intricate world of payment processing. Our next step is to look at the tradeoffs.

The Tradeoffs: What You're Paying For

Higher Processing Costs

Of course, BNPL isn't free. The benefits come with clear costs—literally. BNPL providers charge more than traditional payment methods, with fee effective rates typically running consistently higher than non-Amex credit cards. You're essentially paying for the increased AOV and conversion. These costs can vary across retailers, BNPL partners, and market, so you’ll want to perform a full cost analysis whenever adjusting your BNPL strategy.

Complex Refund Dynamics

This is where BNPL gets interesting—and where your market matters. We analyzed data from global retailers operating in the US and Germany and dug into the refund rates across all BNPL transactions made between January and November of this year. Here’s what we saw:

In the US, BNPL refund rates hover around 11%. This is manageable and actually lower than the 13% average for credit cards.

In Germany, however, those same retailers saw BNPL refund rates spike to 35-45%! The main difference appears to be the popularity of "try-it-at-home" BNPL options like Klarna Invoice in Europe. This particular offering allows customers to receive and use an item for up to 30 days before they pay via a single invoice. When customers can test out a product without paying, they seem more prone to adopt the "eh, send it back" mindset; in fact, 91% of BNPL refunds for one of these merchants in Germany came from this try-before-you-pay model. Further enforcing this conclusion, we see refund rates around 12% in Germany for installment-based BNPL options like Klarna Slice It.

Just to be thorough, we also compared refund rates across non-BNPL payment methods in Germany and the US. Credit card refund rates are also higher in Europe (18-30%) than in the US (11-13%), which suggests broader regional differences in shopping behavior, return policies, and consumer expectations. This regional variation is just another factor to consider when deciding what payment methods to accept in which markets. The decision comes down to whether the increased AOV and transaction volume is enough to offset processing and refund costs—and that calculation often looks different across markets and payment methods.

What about installment counts? Even within installment-based BNPL, refund patterns for transactions with various installment counts aren't exactly linear. Here’s an example of what we saw for one of our merchants across all of their BNPL volume in the last six months:

1 installment: 17-37% refund rate (consistently highest)

3-12 installments: 4-13% (lowest range)

18-24 installments: 14-28% (mid-range)

The takeaway? Refund rates depend on your market, your BNPL payment offerings, and your customer base. You need to monitor your own data to understand how different BNPL configurations affect your returns.

Your Next Steps

If you're not offering BNPL yet, you may want to add it to your payments stack. Customers want it, and they spend more when they have it.

But if you're already on the BNPL train, don't assume you're done optimizing! Here are some actions to consider:

Audit your installment options - Are you capping installments at 3-4 when customers might be inclined to spend more if they can break transactions across more installment counts?

Monitor your refund patterns - Do higher installment counts or certain BNPL payment methods correlate with more returns for your business and products? How does it vary by market?

Calculate your net benefit - Does the increase in AOV offered by higher installment plans offset the processing and potential refund costs?

Test and iterate - Try offering more installment options to a segment and measure the impact! (Remember, A/B testing is one of the pillars of payments optimization).

You Can't Optimize What You Can't See

This is precisely why granular payments visibility matters. When you can break down AOV, refund rates, and fees by payment method and installment count, suddenly you're making strategic decisions instead of flying blind.

With Pagos Insights, you can visualize your entire payments dataset with the granularity to necessary to view AOV, costs, refund rates, and more across BNPL payment methods, installment counts, markets, and more. Only with this information can you ensure your BNPL strategy is optimized for both customer budgets and your bottom line.

Ready to dig into your payments data? Contact us to get started with Pagos Insights.

Buy Now, Pay Later (BNPL) has been steadily increasing in global popularity over the last decade, with options like Klarna, Afterpay, and Affirm swiftly becoming household names. Fortune even reported US customers using BNPL options to spend $1.03 billion shopping online Black Friday sales this year; roughly 7.2% of all US sales that day can be attributed to these installment-based payment methods!

We can link this growth to evolving consumer preferences. BNPL providers have ardently designed products consumers gravitate towards and delight in using. Additionally, BNPL offers budget-conscious shoppers the option to break larger purchases into manageable installment options—transforming "I can't afford this" into "I can make this work."

While there are real pros and cons to accepting BNPL, it’s a payment method most larger merchants have embraced, especially in Europe and the US. But here's what many miss: if you're already accepting BNPL, you might be leaving significant revenue on the table if you haven't optimized your installment strategy! The real question isn't whether to accept BNPL, but which payment types and how many installments to offer.

Higher Installments, Higher Order Values

One of the primary benefits BNPL options like Klarna offer merchants is an increased average order value (AOV). Interestingly enough, we’ve witnessed an extension of this benefit in the data for some of Pagos’ international retailers accepting various Klarna payment methods in the US and Europe: higher installment counts correlating to higher AOVs.

Look at that AOV pattern:

Single installment purchases: ~$165

12 installments: ~$240

18+ installments: >$800

When customers know they can spread payments across more paychecks, they're comfortable spending significantly more. This makes intuitive sense—someone budgeting $200 per paycheck can afford a much larger total purchase over six payments than over three. At this point, the optimization insights seem clear: If you're already accepting BNPL but only offering 3-6 installment options, you might be leaving money on the table!

That being said, we are still talking about the complicated and intricate world of payment processing. Our next step is to look at the tradeoffs.

The Tradeoffs: What You're Paying For

Higher Processing Costs

Of course, BNPL isn't free. The benefits come with clear costs—literally. BNPL providers charge more than traditional payment methods, with fee effective rates typically running consistently higher than non-Amex credit cards. You're essentially paying for the increased AOV and conversion. These costs can vary across retailers, BNPL partners, and market, so you’ll want to perform a full cost analysis whenever adjusting your BNPL strategy.

Complex Refund Dynamics

This is where BNPL gets interesting—and where your market matters. We analyzed data from global retailers operating in the US and Germany and dug into the refund rates across all BNPL transactions made between January and November of this year. Here’s what we saw:

In the US, BNPL refund rates hover around 11%. This is manageable and actually lower than the 13% average for credit cards.

In Germany, however, those same retailers saw BNPL refund rates spike to 35-45%! The main difference appears to be the popularity of "try-it-at-home" BNPL options like Klarna Invoice in Europe. This particular offering allows customers to receive and use an item for up to 30 days before they pay via a single invoice. When customers can test out a product without paying, they seem more prone to adopt the "eh, send it back" mindset; in fact, 91% of BNPL refunds for one of these merchants in Germany came from this try-before-you-pay model. Further enforcing this conclusion, we see refund rates around 12% in Germany for installment-based BNPL options like Klarna Slice It.

Just to be thorough, we also compared refund rates across non-BNPL payment methods in Germany and the US. Credit card refund rates are also higher in Europe (18-30%) than in the US (11-13%), which suggests broader regional differences in shopping behavior, return policies, and consumer expectations. This regional variation is just another factor to consider when deciding what payment methods to accept in which markets. The decision comes down to whether the increased AOV and transaction volume is enough to offset processing and refund costs—and that calculation often looks different across markets and payment methods.

What about installment counts? Even within installment-based BNPL, refund patterns for transactions with various installment counts aren't exactly linear. Here’s an example of what we saw for one of our merchants across all of their BNPL volume in the last six months:

1 installment: 17-37% refund rate (consistently highest)

3-12 installments: 4-13% (lowest range)

18-24 installments: 14-28% (mid-range)

The takeaway? Refund rates depend on your market, your BNPL payment offerings, and your customer base. You need to monitor your own data to understand how different BNPL configurations affect your returns.

Your Next Steps

If you're not offering BNPL yet, you may want to add it to your payments stack. Customers want it, and they spend more when they have it.

But if you're already on the BNPL train, don't assume you're done optimizing! Here are some actions to consider:

Audit your installment options - Are you capping installments at 3-4 when customers might be inclined to spend more if they can break transactions across more installment counts?

Monitor your refund patterns - Do higher installment counts or certain BNPL payment methods correlate with more returns for your business and products? How does it vary by market?

Calculate your net benefit - Does the increase in AOV offered by higher installment plans offset the processing and potential refund costs?

Test and iterate - Try offering more installment options to a segment and measure the impact! (Remember, A/B testing is one of the pillars of payments optimization).

You Can't Optimize What You Can't See

This is precisely why granular payments visibility matters. When you can break down AOV, refund rates, and fees by payment method and installment count, suddenly you're making strategic decisions instead of flying blind.

With Pagos Insights, you can visualize your entire payments dataset with the granularity to necessary to view AOV, costs, refund rates, and more across BNPL payment methods, installment counts, markets, and more. Only with this information can you ensure your BNPL strategy is optimized for both customer budgets and your bottom line.

Ready to dig into your payments data? Contact us to get started with Pagos Insights.

Share this Blog Post

Share this Blog Post

Let's Chat on

Want to dig deeper into payments data, news, and insights? Have hot takes of your own?

We're talking all things payments on Reddit.

Latest Blog Posts

Monitoring and Managing Visa Flexible Credential Adoption

Monitoring and Managing Visa Flexible Credential Adoption

Monitoring and Managing Visa Flexible Credential Adoption

Reduce the Cost of Payments Acceptance in 2026

Reduce the Cost of Payments Acceptance in 2026

Reduce the Cost of Payments Acceptance in 2026

Subscribe to our Blog

Subscribe to

our Blog

Subscribe to our Blog

By submitting, you are providing your consent for future communication in accordance with the Pagos Privacy Policy.

Let's Chat on

Let's Chat on

Want to dig deeper into payments data, news, and insights? Have hot takes of your own?

We're talking all things payments on Reddit.