Industry

Understanding Visa’s New CEDP Program: What You Need to Know

December 19, 2025

December 19, 2025

Mirte Kraaijkamp

Mirte Kraaijkamp

Mirte Kraaijkamp

Visa is rolling out a major update to how they evaluate and price commercial-card transactions. Their new Commercial Enhanced Data Program (CEDP) represents a shift toward greater data accuracy, transparency, and consistency across B2B payments. To maintain compliance and optimize costs, merchants must adapt to new data requirements.

As Visa prepares to sunset legacy Level 2 and Level 3 (L2/L3) data programs in April next year, you need to consider how CEDP will impact your processing costs. The new interchange rates associated with enhanced data won’t be as accessible as they once were. With the right data, however, you can proactively adjust your payments strategy accordingly and monitor cost changes closely.

What Is CEDP, and Why Is It Being Introduced?

Historically, Visa has incentivized businesses to collect and pass enhanced data through its L2/L3 programs. These programs rewarded merchants with lower interchange rates for including additional transaction details like sales tax amounts, order numbers, or product descriptions. Merchants quickly realized they could qualify for L2/L3 savings even when the additional data was incomplete or filled with static data. Over time, this created inconsistencies in data quality and weakened the value of enhanced-data incentives for Visa.

In an attempt to modernize and tighten this system, Visa launched CEDP. It introduces a verification-driven approach, whereby merchants can only receive lower interchange rates on commercial transactions once Visa verifies their compliance with new enhanced data requirements. This is Visa’s way of ensuring merchants consistently collect and pass complete and accurate invoice-level details, such as item descriptions, quantities, taxes, and freight.

How CEDP Differs from Legacy L2/L3 Data

While it may feel like a rebranding, Visa’s shift from L2/L3 to CEDP actually represents a fundamental change in how they treat enhanced data. Under L2/L3, merchants could often qualify for lower rates simply by meeting minimal data requirements, even if the included fields didn’t meaningfully describe a given transaction. CEDP removes that flexibility by requiring:

Better data - Merchants must pass specific, accurate, and detailed enhanced data with each commercial transaction to qualify for lower interchange rates

Consistent data - Visa will review merchants regularly to confirm they consistently pass high-quality, line-item data; those found lacking will be flagged as “non-verified”

Meaningful data - Visa will apply a 0.05% participation fee to every enhanced-data transaction, essentially penalizing merchants for passing generic or placeholder data

This creates a more reliable structure for commercial-card transactions while simultaneously raising the bar for merchants accustomed to legacy qualification rules.

What’s Changing with Interchange Rates?

With the rollout of CEDP, interchange costs are on the rise. Here’s a basic breakdown of what to expect with Visa’s commercial interchanges rates as a part of the transition:

Level 2 rates are up 0.75% across the board

Product 3/Level 3 rates are up slightly less to 0.65%

Visa Commercial/Corporate Level 3 - Non-Travel decreases by 0.15% (*for verified merchants only)

Ultimately, your cost impact depends on the mix of card types you accept and the amount of data you collect and pass with your transaction volume.

Preparing for CEDP

CEDP applies to all Visa commercial credit-card transactions in the United States. This includes corporate, purchasing, business, and government cards commonly used in procurement-heavy industries and B2B workflows. If that describes any of your transaction volume, you need to begin evaluating your data readiness now—merchants who prepare early will avoid cost increases and benefit from improved qualification rates.

We recommend taking the following steps to ensure you’re not caught off guard as Visa phases out L2/L3 incentives in 2025–2026:

Identify where your invoice-level detail originates, typically in your ERP, invoicing platform, ecommerce system, or order management tools.

Verify your payment provider can capture and transmit this data in the format Visa requires.

Conduct an internal audit of your enhanced-data flows, then validate how often your transactions meet CEDP criteria.

Update any legacy integrations built around looser L2/L3 requirements. Remember: Merchants who continue sending incomplete or generic data will lose access to enhanced rates while still paying the participation fee!

How Pagos Is Supporting CEDP Adoption

To help you understand the impact of this industry shift, we’re updating the Opportunities page in Pagos Insights to reflect Visa’s new CEDP structure. The Enhanced Data Opportunity value will incorporate the updated interchange program to highlight your total potential savings under CEDP. We expect to roll out these updates in early 2026.

For those who want to explore the changes further, you can use the Costs section of Insights or build custom Charts to analyze fees associated with enhanced data. For example, if you create a chart showing Fee Amount filtered to the “Enhanced Data” Fee Type, you can see when these fees appear and how they contribute to overall processing costs:

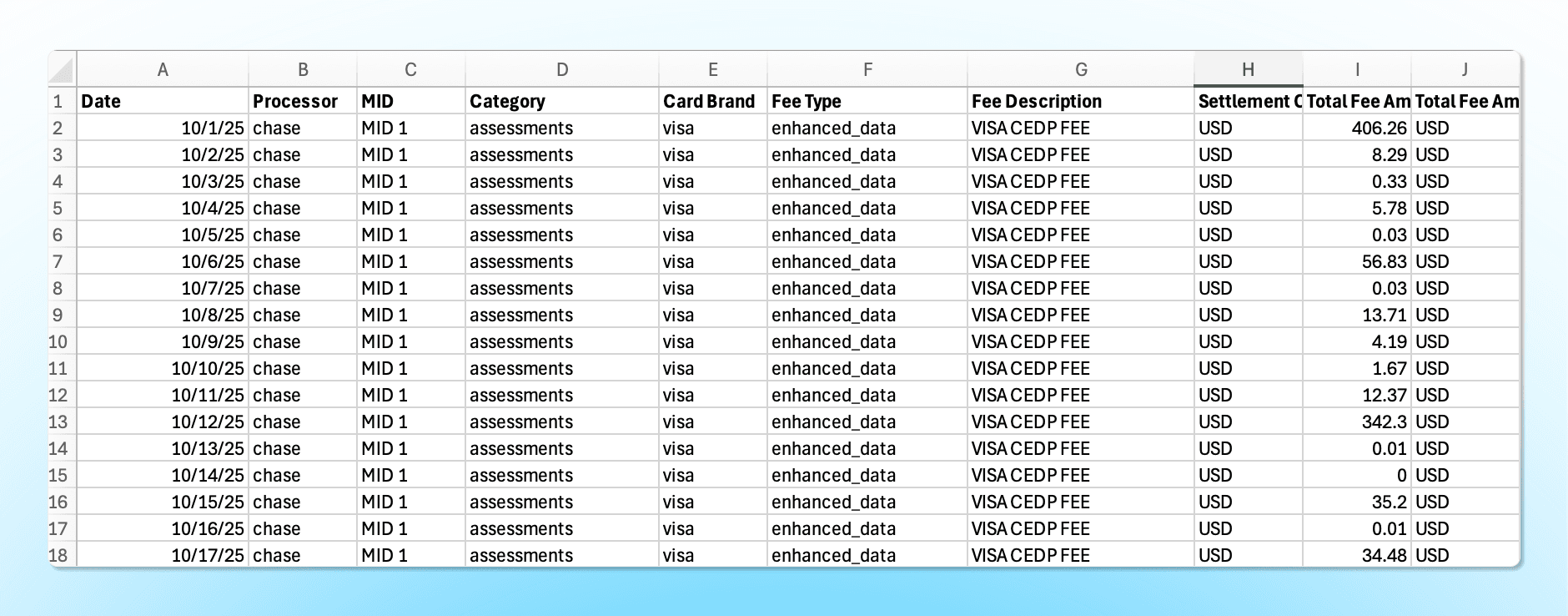

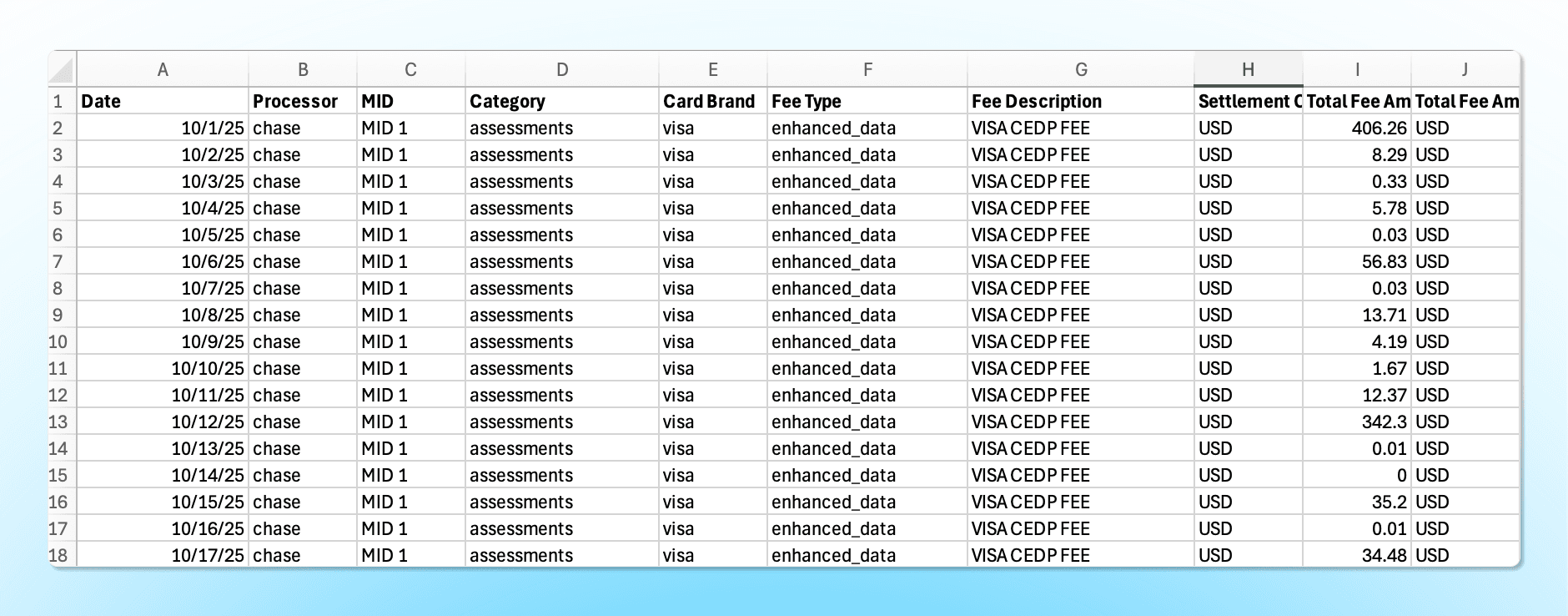

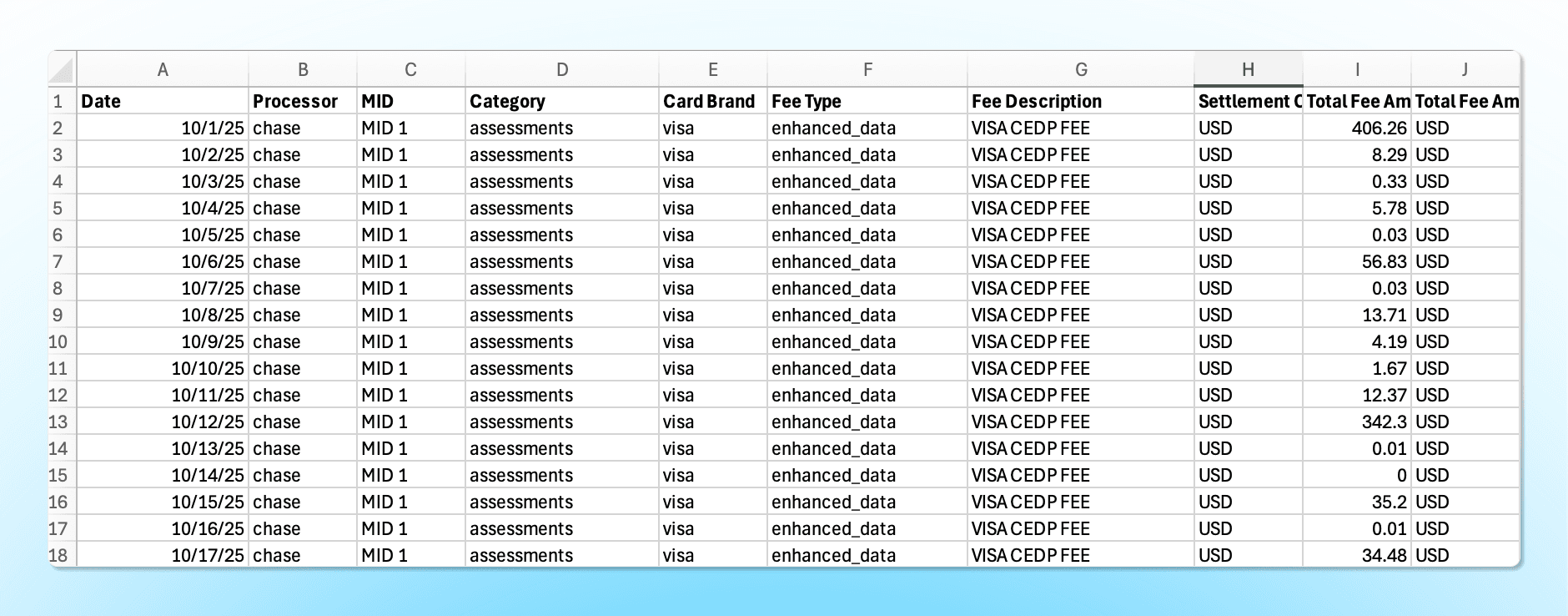

If you want deeper visibility, you can export your fee data directly to view enhanced data fees broken down by MID and fee description; this makes it easy to identify exactly which CEDP-related fees apply to your own transactions:

Visa’s shift to CEDP sets a new standard for commercial-card enhanced data. Our team here at Pagos is keeping on top of any new developments out of Visa, and will ensure you have all the data necessary to adjust your strategy and maintain interchange savings.

Visa is rolling out a major update to how they evaluate and price commercial-card transactions. Their new Commercial Enhanced Data Program (CEDP) represents a shift toward greater data accuracy, transparency, and consistency across B2B payments. To maintain compliance and optimize costs, merchants must adapt to new data requirements.

As Visa prepares to sunset legacy Level 2 and Level 3 (L2/L3) data programs in April next year, you need to consider how CEDP will impact your processing costs. The new interchange rates associated with enhanced data won’t be as accessible as they once were. With the right data, however, you can proactively adjust your payments strategy accordingly and monitor cost changes closely.

What Is CEDP, and Why Is It Being Introduced?

Historically, Visa has incentivized businesses to collect and pass enhanced data through its L2/L3 programs. These programs rewarded merchants with lower interchange rates for including additional transaction details like sales tax amounts, order numbers, or product descriptions. Merchants quickly realized they could qualify for L2/L3 savings even when the additional data was incomplete or filled with static data. Over time, this created inconsistencies in data quality and weakened the value of enhanced-data incentives for Visa.

In an attempt to modernize and tighten this system, Visa launched CEDP. It introduces a verification-driven approach, whereby merchants can only receive lower interchange rates on commercial transactions once Visa verifies their compliance with new enhanced data requirements. This is Visa’s way of ensuring merchants consistently collect and pass complete and accurate invoice-level details, such as item descriptions, quantities, taxes, and freight.

How CEDP Differs from Legacy L2/L3 Data

While it may feel like a rebranding, Visa’s shift from L2/L3 to CEDP actually represents a fundamental change in how they treat enhanced data. Under L2/L3, merchants could often qualify for lower rates simply by meeting minimal data requirements, even if the included fields didn’t meaningfully describe a given transaction. CEDP removes that flexibility by requiring:

Better data - Merchants must pass specific, accurate, and detailed enhanced data with each commercial transaction to qualify for lower interchange rates

Consistent data - Visa will review merchants regularly to confirm they consistently pass high-quality, line-item data; those found lacking will be flagged as “non-verified”

Meaningful data - Visa will apply a 0.05% participation fee to every enhanced-data transaction, essentially penalizing merchants for passing generic or placeholder data

This creates a more reliable structure for commercial-card transactions while simultaneously raising the bar for merchants accustomed to legacy qualification rules.

What’s Changing with Interchange Rates?

With the rollout of CEDP, interchange costs are on the rise. Here’s a basic breakdown of what to expect with Visa’s commercial interchanges rates as a part of the transition:

Level 2 rates are up 0.75% across the board

Product 3/Level 3 rates are up slightly less to 0.65%

Visa Commercial/Corporate Level 3 - Non-Travel decreases by 0.15% (*for verified merchants only)

Ultimately, your cost impact depends on the mix of card types you accept and the amount of data you collect and pass with your transaction volume.

Preparing for CEDP

CEDP applies to all Visa commercial credit-card transactions in the United States. This includes corporate, purchasing, business, and government cards commonly used in procurement-heavy industries and B2B workflows. If that describes any of your transaction volume, you need to begin evaluating your data readiness now—merchants who prepare early will avoid cost increases and benefit from improved qualification rates.

We recommend taking the following steps to ensure you’re not caught off guard as Visa phases out L2/L3 incentives in 2025–2026:

Identify where your invoice-level detail originates, typically in your ERP, invoicing platform, ecommerce system, or order management tools.

Verify your payment provider can capture and transmit this data in the format Visa requires.

Conduct an internal audit of your enhanced-data flows, then validate how often your transactions meet CEDP criteria.

Update any legacy integrations built around looser L2/L3 requirements. Remember: Merchants who continue sending incomplete or generic data will lose access to enhanced rates while still paying the participation fee!

How Pagos Is Supporting CEDP Adoption

To help you understand the impact of this industry shift, we’re updating the Opportunities page in Pagos Insights to reflect Visa’s new CEDP structure. The Enhanced Data Opportunity value will incorporate the updated interchange program to highlight your total potential savings under CEDP. We expect to roll out these updates in early 2026.

For those who want to explore the changes further, you can use the Costs section of Insights or build custom Charts to analyze fees associated with enhanced data. For example, if you create a chart showing Fee Amount filtered to the “Enhanced Data” Fee Type, you can see when these fees appear and how they contribute to overall processing costs:

If you want deeper visibility, you can export your fee data directly to view enhanced data fees broken down by MID and fee description; this makes it easy to identify exactly which CEDP-related fees apply to your own transactions:

Visa’s shift to CEDP sets a new standard for commercial-card enhanced data. Our team here at Pagos is keeping on top of any new developments out of Visa, and will ensure you have all the data necessary to adjust your strategy and maintain interchange savings.

Visa is rolling out a major update to how they evaluate and price commercial-card transactions. Their new Commercial Enhanced Data Program (CEDP) represents a shift toward greater data accuracy, transparency, and consistency across B2B payments. To maintain compliance and optimize costs, merchants must adapt to new data requirements.

As Visa prepares to sunset legacy Level 2 and Level 3 (L2/L3) data programs in April next year, you need to consider how CEDP will impact your processing costs. The new interchange rates associated with enhanced data won’t be as accessible as they once were. With the right data, however, you can proactively adjust your payments strategy accordingly and monitor cost changes closely.

What Is CEDP, and Why Is It Being Introduced?

Historically, Visa has incentivized businesses to collect and pass enhanced data through its L2/L3 programs. These programs rewarded merchants with lower interchange rates for including additional transaction details like sales tax amounts, order numbers, or product descriptions. Merchants quickly realized they could qualify for L2/L3 savings even when the additional data was incomplete or filled with static data. Over time, this created inconsistencies in data quality and weakened the value of enhanced-data incentives for Visa.

In an attempt to modernize and tighten this system, Visa launched CEDP. It introduces a verification-driven approach, whereby merchants can only receive lower interchange rates on commercial transactions once Visa verifies their compliance with new enhanced data requirements. This is Visa’s way of ensuring merchants consistently collect and pass complete and accurate invoice-level details, such as item descriptions, quantities, taxes, and freight.

How CEDP Differs from Legacy L2/L3 Data

While it may feel like a rebranding, Visa’s shift from L2/L3 to CEDP actually represents a fundamental change in how they treat enhanced data. Under L2/L3, merchants could often qualify for lower rates simply by meeting minimal data requirements, even if the included fields didn’t meaningfully describe a given transaction. CEDP removes that flexibility by requiring:

Better data - Merchants must pass specific, accurate, and detailed enhanced data with each commercial transaction to qualify for lower interchange rates

Consistent data - Visa will review merchants regularly to confirm they consistently pass high-quality, line-item data; those found lacking will be flagged as “non-verified”

Meaningful data - Visa will apply a 0.05% participation fee to every enhanced-data transaction, essentially penalizing merchants for passing generic or placeholder data

This creates a more reliable structure for commercial-card transactions while simultaneously raising the bar for merchants accustomed to legacy qualification rules.

What’s Changing with Interchange Rates?

With the rollout of CEDP, interchange costs are on the rise. Here’s a basic breakdown of what to expect with Visa’s commercial interchanges rates as a part of the transition:

Level 2 rates are up 0.75% across the board

Product 3/Level 3 rates are up slightly less to 0.65%

Visa Commercial/Corporate Level 3 - Non-Travel decreases by 0.15% (*for verified merchants only)

Ultimately, your cost impact depends on the mix of card types you accept and the amount of data you collect and pass with your transaction volume.

Preparing for CEDP

CEDP applies to all Visa commercial credit-card transactions in the United States. This includes corporate, purchasing, business, and government cards commonly used in procurement-heavy industries and B2B workflows. If that describes any of your transaction volume, you need to begin evaluating your data readiness now—merchants who prepare early will avoid cost increases and benefit from improved qualification rates.

We recommend taking the following steps to ensure you’re not caught off guard as Visa phases out L2/L3 incentives in 2025–2026:

Identify where your invoice-level detail originates, typically in your ERP, invoicing platform, ecommerce system, or order management tools.

Verify your payment provider can capture and transmit this data in the format Visa requires.

Conduct an internal audit of your enhanced-data flows, then validate how often your transactions meet CEDP criteria.

Update any legacy integrations built around looser L2/L3 requirements. Remember: Merchants who continue sending incomplete or generic data will lose access to enhanced rates while still paying the participation fee!

How Pagos Is Supporting CEDP Adoption

To help you understand the impact of this industry shift, we’re updating the Opportunities page in Pagos Insights to reflect Visa’s new CEDP structure. The Enhanced Data Opportunity value will incorporate the updated interchange program to highlight your total potential savings under CEDP. We expect to roll out these updates in early 2026.

For those who want to explore the changes further, you can use the Costs section of Insights or build custom Charts to analyze fees associated with enhanced data. For example, if you create a chart showing Fee Amount filtered to the “Enhanced Data” Fee Type, you can see when these fees appear and how they contribute to overall processing costs:

If you want deeper visibility, you can export your fee data directly to view enhanced data fees broken down by MID and fee description; this makes it easy to identify exactly which CEDP-related fees apply to your own transactions:

Visa’s shift to CEDP sets a new standard for commercial-card enhanced data. Our team here at Pagos is keeping on top of any new developments out of Visa, and will ensure you have all the data necessary to adjust your strategy and maintain interchange savings.

Share this Blog Post

Share this Blog Post

Let's Chat on

Want to dig deeper into payments data, news, and insights? Have hot takes of your own?

We're talking all things payments on Reddit.

Latest Blog Posts

From Internal Experiment to Public Release: Bringing Conversational Payments Data to our Customers via MCP

From Internal Experiment to Public Release: Bringing Conversational Payments Data to our Customers via MCP

From Internal Experiment to Public Release: Bringing Conversational Payments Data to our Customers via MCP

Introducing the Real Talk Payments Podcast

Introducing the Real Talk Payments Podcast

Introducing the Real Talk Payments Podcast

Subscribe to our Blog

Subscribe to

our Blog

Subscribe to our Blog

By submitting, you are providing your consent for future communication in accordance with the Pagos Privacy Policy.

Let's Chat on

Let's Chat on

Want to dig deeper into payments data, news, and insights? Have hot takes of your own?

We're talking all things payments on Reddit.